On September 8 and 9, 2025, protests across Nepal voiced more than frustration with poor governance and slow growth. From streets to social media, young Nepalis demanded a system that rewards integrity and merit over influence and favoritism.

The movement mirrors a global shift as climate change and economic pressures force societies to rethink conventional political and development models. Despite Nepal’s vast clean energy potential, nearly a third of its GDP still funds energy imports, leaving the country dependent on costly, polluting fuels. This constrains jobs, education, and opportunity, driving many young people to seek work abroad.

At its core, the youth-led movement calls for structural reform, transparency, accountability. The interim government is trying to restore optimism; with elections ahead, hopes for meaningful reform feel stronger than in years. Nepal, once a hub of knowledge, commerce, and culture, has seen progress stall through instability. As a new generation steps forward to rebuild, one transformative solution stands out: green hydrogen.

Hydrogen is drawing global attention. Heavy industry, long-distance transport, and manufacturing cannot rely solely on direct electrification. Green hydrogen, produced with renewables, can decarbonize processes electricity alone cannot.

Many countries now have strategies linking green hydrogen to growth, energy security, and new industry. Nepal’s advantage is clear: abundant hydropower awaiting fuller use. Aligning domestic priorities with the global clean-energy wave is an opportunity we should not miss

Hydropower to Hydrogen: Nepal’s Untapped Strength

Nepal’s total energy use is increasing by 4 percent annually. The mix includes biomass, petroleum, coal, hydroelectricity, and other renewables. While biomass fell from 66 percent (2021) to 58.53 percent (2022), petroleum consumption steadily increased sustainable growth. Fossil fuel imports comprised over 14 percent of imports in 2022 providing about 65 percent of industrial heat. Without timely action, population and industrial growth will lock in higher emissions and import dependence.

Nepal’s hydropower remains underutilized: technical potential exceeds 150,000 MW, including storage. In 2023/24, about NPR 2.8 billion worth of electricity was wasted across 20 projects due to transmission and substation bottlenecks. Capacity targets envision 15,000 MW by 2030 and 28,000 MW by 2035, with an expected surplus near 18,000 MW by 2035. Yet Nepal faces a dual challenge: rising coal and diesel imports alongside underused domestic power. Hydrogen can absorb surplus electricity, cut imports, and anchor new heavy industry.

Green hydrogen from hydropower, solar, or wind can be stored and used in power, transport, and industry. In dedicated zones, it can power the production of green ammonia, urea, cement, and steel, strengthening local industry and creating export opportunities.

In a multipolar world where energy shapes influence, hydrogen can be economic diplomacy for Nepal, bolstering energy independence, export potential, and prosperity. Investing in hydrogen hedges fuel-price shocks and elevates Nepal’s role in South Asia’s energy future.

The Vision of Nepal as a Regional Hydrogen Hub

A Hydrogen Hub (HH) is a large-scale system integrating production, storage, distribution, and use across multiple applications. Nepal’s abundant renewables, high fossil-fuel imports, and location between major economies make it a strong candidate.

Nepal sits between India’s National Green Hydrogen Mission (Five million tonnes by 2030) and China, the global electrolyzer leader. Japan and South Korea, major energy importers, seek reliable hydrogen supply to meet net-zero goals. Hydropower-based hydrogen aligns with Japan’s import strategy and Korea’s Hydrogen Roadmap 2040.

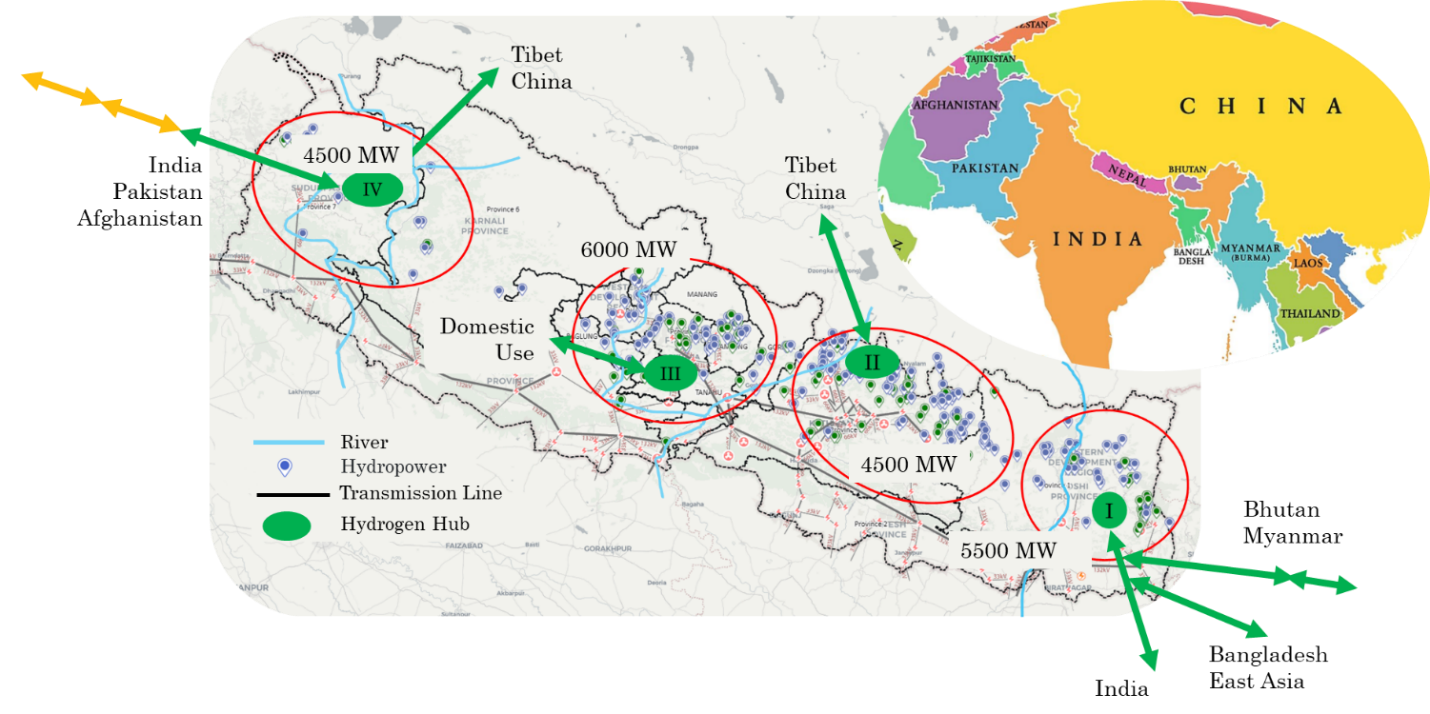

It is feasible to establish four Hydrogen Hubs near key hydropower zones, building on existing and planned generation.

The first Hydrogen Hub (HH-I) is proposed in the eastern region of Nepal, where a hydropower project of capacity 5500 MW is under development, while HH-II, HH-III, and HH-IV are located in areas with 4000 MW, 6000 MW, and 4500 MW of hydropower projects. The capacity of each Hydrogen Hub is estimated to be one-third of the total installed hydropower. Each hub’s capacity could be about one-third of local installed hydropower. HH-I could serve the eastern corridor (India, Bhutan, Bangladesh, Myanmar) via ammonia trade; HH-II would offer flexibility toward China; HH-III in central Nepal could drive domestic green steel, cement, ammonia, urea, and synthetic fuels; HH-IV in the west could explore trade toward India, Pakistan, and Afghanistan.

Positioning Nepal as a regional hydrogen hub advances energy transition, green growth, and energy diplomacy. With resources, strategy, and a reform mandate, Nepal can shift from energy importer to clean-energy exporter.

Policy Milestones: Nepal’s Green Hydrogen Journey

Nepal has already begun turning the vision of a Hydrogen Economy and Trade into national policies and action plans. In 2021 (2078 BS) the government formed a Green Hydrogen Coordination Committee and a committee on hydrogen-based fertilizer. High-level consultations led to inclusion of a hydrogen fertilizer plant in the 2079/80 (2022/23) budget and feasibility work by provinces and the Investment Board. In January 2024 (2080 BS), the Cabinet approved a Green Hydrogen Policy establishing institutional frameworks, tax and customs incentives, and guidance for transport, industry, and fertilizer. Subsequent budgets (2081/82 and 2082/83) elevated hydrogen to a strategic energy sector, pledged net-zero by 2045, funded R&D, and granted a five-year tax holiday for hydrogen industries.

The academic sector has been catalytic in this transition. Kathmandu University’s Green Hydrogen Lab (est. 2077 BS) and the National Hydrogen Initiative (2078 BS) lead work on production, storage, and applications, partnering with government, firms, and international organizations (e.g., GGGI, NTNU, and institutions in South Korea and China). In August 2024, KU inaugurated South Asia’s first university-based green hydrogen production and refueling station with Nepal Oil Corporation—signaling readiness for commercial projects.

Private sector engagement in the business development of green hydrogen in Nepal is growing. Hydropower developers, including Buddha Bhumi Nepal Hydropower Company, have announced pilots. Koshi Province signed an MoU for an NPR 26 billion hydrogen-based fertilizer plant. In 2025, South Korea’s G-Philos obtained Investment Board approval to study a 20 MW hydrogen and fuel-cell plant.

Together these steps reflect rising confidence in Nepal’s energy potential and lay the groundwork for domestic use and export.

Nepal stands at a turning point where the energy of its youth meets the opportunity of clean technology. What began as a demand for fairness and accountability now links to a broader vision of national renewal.

Hydrogen is more than a technology, it signals a development model grounded in integrity, innovation, and resilience. With abundant resources, strategic location, and growing expertise, Nepal can lead regionally in clean energy.

Realizing this vision requires bilateral and multilateral partners and technology providers to mobilize investment, reduce risk, and support execution, the interim and incoming governments must provide clear policy, coordination, and targeted support, turning frustration into opportunity, migration into innovation, and hope into action. Ultimately, Nepal’s future hinges not only on politics but also on how boldly we invest in our people and the power of our rivers.